Leverage social media to boost insurance sales

As more and more technological breakthroughs are made, social media has become a critical part of the insurance industry. Platforms such as Facebook and LinkedIn have powerful tools to increase your reach and boost your insurance sales. Moreover, reaching out to prospects is much easier through social media, provided you post great content that drives traffic to your website.

Another benefit of leveraging social media to polish your insurance operations is the minimal effort and cost. All it takes is knowledge and creativity to properly interact with your customers online.

To help you take the right approach to your insurance company’s social media efforts, we’ll list some of the most useful strategies you can apply to drive your insurance sales. Additionally, they can help you market your services better and reach more prospects.

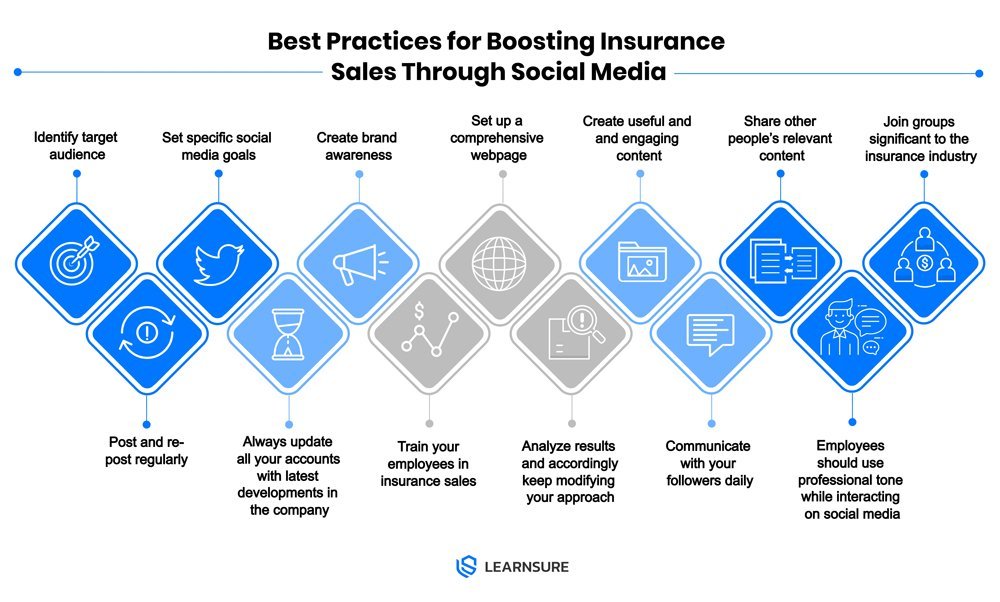

What Are the Best Practices for Boosting Insurance Sales Through Social Media?

Once you’ve created profiles on different platforms, here’s what you can do to offer a better customer experience and generate more insurance sales with your initiatives:

Create Brand Awareness

Right from the start of your operations, you’ll want to come up with a brand identity to which your target customers can relate. Whether you decide to host cultural events or publicly support charity groups, it’s crucial to set the tone with your brand using social media to reach a large audience.

Set Up a Comprehensive Webpage

Insurance companies planning to allocate some of their marketing efforts online need a comprehensive and well-designed website. It plays a vital role in making your presence felt on social media.

Since your webpage will be the go-to site for questions, it’s a good idea to set up a chatbot, a computer program that uses artificial intelligence to chat with customers online. This is because nearly 1.5 billion people use chatbots for support, which is why you can expect some of your customers to embrace the same approach when looking for answers.

Create Useful and Relevant Content

Whether you’re creating an infographic or blog post, make sure your content provides relevant information to your target customers. To do this, you need to stay up to speed with the burning issues in the insurance industries and come up with content covering these topics. Also, the content needs to be concise and detailed since your followers will look for quality and not quantity.

Share Other People’s Content

Considering that you’re running an insurance business and not a content writing company, your customers should always be able to turn to you for useful, relevant information. For this reason, share relevant posts from your industry’s thought leaders to complement your native content. Establishing relationships with prominent industry names can improve your website’s visibility and allow you to target more people with your marketing efforts.

Post Regularly

Reaching out to your customers regularly is key to reinforcing your presence on social media and starting relationships. So, persuade your followers to stick with you by providing regular posts (daily, weekly, etc.) on all your platforms, including LinkedIn, Twitter, and Facebook.

Include Videos and Pictures

Incorporating media into your content is a great way to make your posts more shareable and promote follower interaction. Again, the videos and pictures you include need to be relevant to the content on the website. Also, try to avoid posting the same or similar pictures too often.

Generate Leads

Not only is social media perfect for establishing an online presence, but it can also help you grow your company. This is where generating leads comes into play. By setting up webinars or sending regular emails, you can ensure that your customers have a better experience interacting with your website.

You can optimize your lead generation efforts in many ways:

- Enhance your profile – Your clients need to be able to find you easily and get to know you. For this reason, your profiles should clearly present your services and provide contact information (e.g., email or phone).

- Establish useful connections – Subscribe to LinkedIn Premium to get in touch with people responsible for getting coverage.

- Monitor brand mentions – It’s always good to know where your brand name appears to avoid missing out on potential sales opportunities. To that end, you can check out some social media management platforms that keep track of your brand mentions.

- Create contests – Include incentives, such as contests, to attract more attention to your social media websites. The email addresses collected from the entries can be used for future promotional efforts. But make sure to check the regulations in your state before designing a contest to avoid violating privacy laws.

Train Your Employees

Next, your employees need to be adequately trained in insurance sales to provide your customers with factual and relevant information. A great solution to this is integrating with a learning experience platform (LXP), such as Learnsure. One of the reasons Learnsure is the ideal option is that it offers diverse skill development methods, such as simulations, gamification, and microlearning. The learning material is specially designed for insurance companies.

Teaching your employees about compliance and other insurance-related affairs is crucial if you want to engage with an online audience. Since using social media is 75% more likely to trigger more traffic, you can expect exposure to more people. Providing them with inaccurate information can only lead to dissatisfied clients who may turn to other companies if your online services aren’t satisfactory. Therefore, train your employees with Learnsure to allow for a better e-learning experience and greater knowledge retention.

Once you integrate with our platform, we’ll apply numerous approaches, such as personalized and simulated learning. In this way, the experience will be fully engaging and your team members will know exactly how to apply the newly acquired skills on social media. More specifically, they will improve their ability to announce new coverage options or product lines, cross-sell to current clients, and post persuasive success stories. The customers will recognize your employees’ expertise, meaning that more potential buyers will be on their way.

Analyze Results and Modify Your Approach

Whether you’re using Google Analytics or Facebook Insights, don’t forget to regularly check the performance of your posts. This way, you’ll see which topics have gained traction among your target audience. Based on these results, you’ll understand what your customers expect, allowing you to modify future posts.

Make Every Marketing Effort Count

Social media is a great way to spread the word about your company and generate more sales. One of the most significant advantages of utilizing it is access to a vast audience. However, creating a profile isn’t enough to market your services adequately. You need to offer excellent content and nurture leads that will help your business grow.

To make certain that your team members appropriately interact with online prospects, organize comprehensive, technology-centred insurance training using Learnsure. Give our platform a go and check out how you can enhance your workplace learning. Don’t miss out on optimal workplace training solutions to improve your customer relations.