Leadership strategies to grow the bancassurance channel

In today’s consolidating world of finance, bancassurance has assumed a vital role in many financial institutions. Hence, banks and insurance companies need sustainable strategies to grow the bancassurance channel and emerge as a leader. Insurance offerings distributed through banks have become the go-to choice for most mass-market customers looking for low-cost and simple products from a trusted company.

Globally, this large channel has allowed banks to broaden their portfolio and enabled insurance companies to enlarge their presence. As a result, the market reached a staggering value of $1191 billion last year.

However, the ongoing digital transformation has brought about significant changes to the industry. The world of bancassurance has been modernized, and customer habits have changed drastically. Consequently, banking and finance organizations can no longer rely on outdated methods to run their operations and grow their channel.

Instead, some of the most influential players have adopted fresh approaches to growing their bancassurance channel, and you’re about to find out how they work.

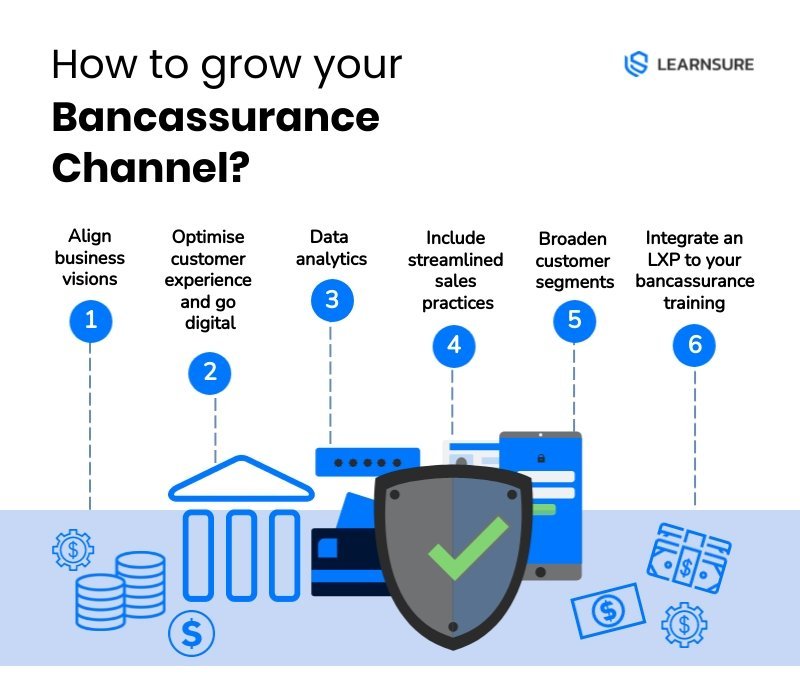

What Are the Best Ways to Grow Your Bancassurance Channel?

Bancassurance comes with tremendous benefits to both institutions involved. To name a few, the organizations get a diversified customer portfolio, improved customer loyalty, increased premium turnover, and reduced costs.

Still, you can take these advantages to the next level by growing your bancassurance channel. Here’s what you can do:

Align Business Visions

Alignment of culture, priorities, and vision is generally clear early on but often gets obscured over time. This is because parties tend to change their priorities, management and show frustration due to insufficient progress.

For this reason, setting up robust governance from the very beginning, along with clear roles and success metrics, is crucial. It would be best to complement this with periodic assessments of your partnership, what works well, and what you need to change.

Optimise Customer Journey

Bancassurance client journeys are generally complicated since the systems aren’t integrated properly. There’s also a lack of harmony between the parties, making the whole experience even more cumbersome for the customer.

Although establishing seamless journeys isn’t straightforward, ignoring this problem isn’t optional. Optimizing customer experience provides better services for your clients and increases the chances of retaining your customers.

Data Analytics

Targeted analytics is another aspect critical to growing your bancassurance channel. On the one hand, banks get more marketing prowess with proper analytics in place. Some of the most important areas that benefit from this practice include risk, compliance, NPA monitoring, fraud, and value at risk calculation. In turn, this improves performance and allows executives to make informed decisions on time.

On the other hand, insurance companies can appraise and control risk in pricing, underwriting, claims, rating, reserving, and marketing. Additionally, they can use the data for claim fraud and claim provider fraud instances.

Overall, targeted analytics help companies optimize the performance of their bancassurance channel and increase safety during various operations.

Broaden Customer Segments

Many insurers generally focus on optimizing branch leads and bundling loans with insurance for retail clients. While this is beneficial, banks and insurance companies can also utilize non-branch channels to improve their channels. For example, they can tap into the potential of call centres and expand products to different segments, such as corporates, SMEs, and HNWs.

To execute this proposal, banks should view it as a top priority. At the same time, insurers must develop bespoke offerings and appropriately service the segments.

Incorporating Streamlined Sales Practices

In general, financial incentives can no longer provide a significant contribution since insurance sales make up a low percentage of a bank’s KPIs. Banks also intensively deal with conduct risk, which is why insurers should focus on the effectiveness of sales forces over an extended period.

One of the best ways to implement this strategy is to expand your non-financial rewards to include recognition as the main motivator. Another driver of value is to granularly map roles and responsibilities within both parties. Plus, make sure to scale your resources and support the banking staff adequately.

Digitally enabled customer experience

As previously noted, customer behaviours are changing rapidly. Perhaps the most profound impact of this development is the switch to digital bancassurance channels. Integrating with cutting-edge systems will help you deliver a better user experience because consumers need a quick way to purchase your products.

Through these processes, you should enable real-time contracting and quoting that eliminates reliance on paper and manual underwriting. To enhance simplicity, prepopulate your applications with bank and insurer data or any other source. Moreover, try to promote transparency and engagement by encouraging customer action, like peer reviews.

Another great thing about digitalization is that it allows insurers to broaden their engagement by participating in banks’ ecosystems. As a result, they can generate more leads and sell their offerings to a larger audience.

Incorporate an LXP to Provide Bancassurance Training

Since bancassurance requires your employees to work in an omnichannel environment, they’ll need to acquire job-specific skills. The easiest way to teach them is to integrate with a polished LXP (Learning Experience Platform).

For instance, client interaction can make or break your chances of landing a successful sale. To make sure your team is ready for even the most challenging tasks, you can get an LXP equipped with microlearning content, gamification modules, and design thinking initiatives. All these features help prepare them for real-life assignments. Plus, you can address any shortcomings depending on feedback received from the platform.

Additionally, LXPs help you overcome the time constraints in training your employees. Due to their demanding workloads, they may not have the opportunity to acquire the necessary skills. Fortunately, an LXP lets your workers learn at their own pace under a flexible program that fits their schedule.

A Huge Bancassurance Channel Is Within Reach

Bancassurance is an incredibly challenging field, with numerous obstacles standing in the way to success. But once you implement all the leadership strategies we’ve covered, growing your channel will be a walk in the park. Aspects like aligning your vision and optimizing sales practices will lead to a better customer experience and streamline your operations.

Best of all, teaching your staff about all these changes won’t give you a hard time. Just reach out to Learnsure, and you’ll receive a tailor-made corporate training solution ideal for your environment. Book a demo and check out how we can aid your bancassurance efforts.